Let’s explore Home Ownership

About two thirds of American households own the house they live in. This accounts for nearly 83 million households.

Most people buy their house with a mortgage (a loan from a bank that is paid off over 10, 20 or often 30 years).

If you are able to either buy your house with cash (no mortgage) or when you eventually pay off your mortgage you monthly expenses go way down.

You will still need to pay for utilities and property taxes and of course there will still be repairs that need to be paid for,

but this makes a big difference in monthly expenses.

When we look at the median value of those units with a mortgage ($341,535).

it is significantly higher than the median value of units without a mortgage ($288,329).

There are several possible reasons why a mortgaged home might be worth 20% more than one without a mortgage.

First, it may be that it’s an older person who is selling their big house and buying a smaller one now that the kids have grown.

Secondly, it may be that because it is smaller the owner could afford it without having to get a mortgage.

Remember this is a median – which means that half of the units are less than this number and half are more than it.

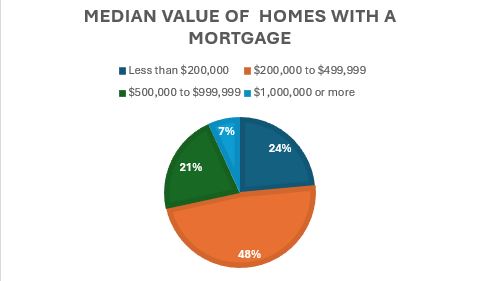

According to the US Census Bureau’s American Community Survey 2023 nearly half of all homes with

a mortgage cost between $200,000 and $500,000 dollars. And 31% cost more than half a million dollars.

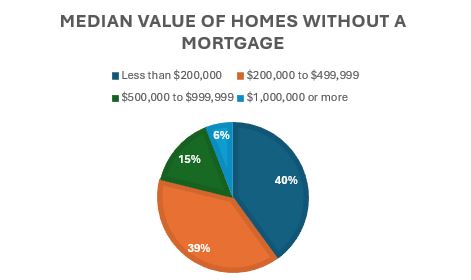

Whereas less than 40% of all homes without a mortgage cost between $200,000 and $500,000 .

And only 21% cost more than half a million dollars. There are 40% that cost less than $200,000.

It’s easy to run data reports about home ownership, educational attainment, income, family structure, households and hundreds

of other variables with GeoLytics demographic data products – like our American Community Survey or our Estimates and Projections.